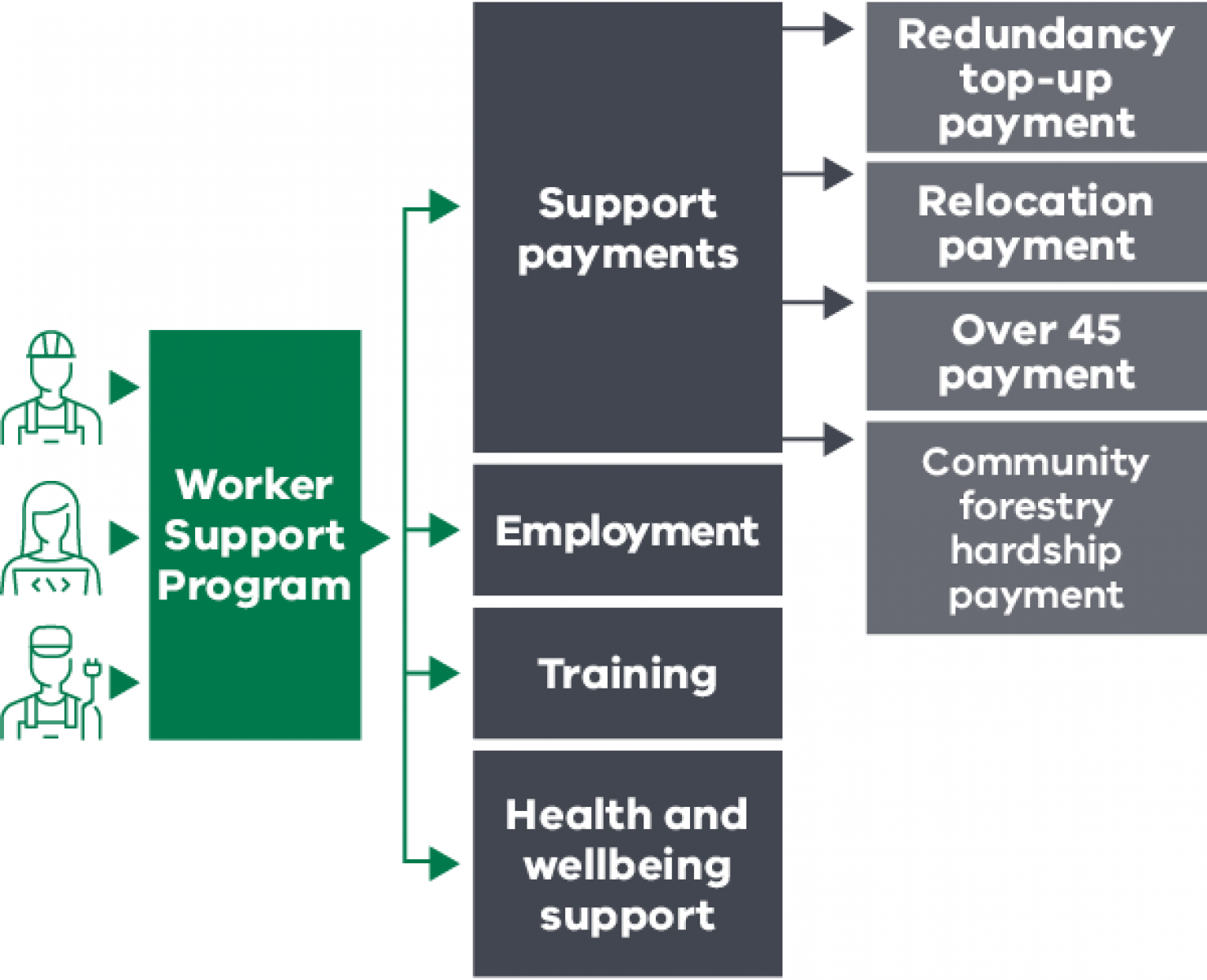

Includes:

- Timber mill workers (except Opal Australian Paper Maryvale Mill workers)

- Harvest and haulage contractors, their workers and sub-contractors

- Community Forestry workers, including seed collectors and chip-truck drivers

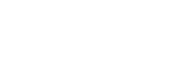

Eligible for:

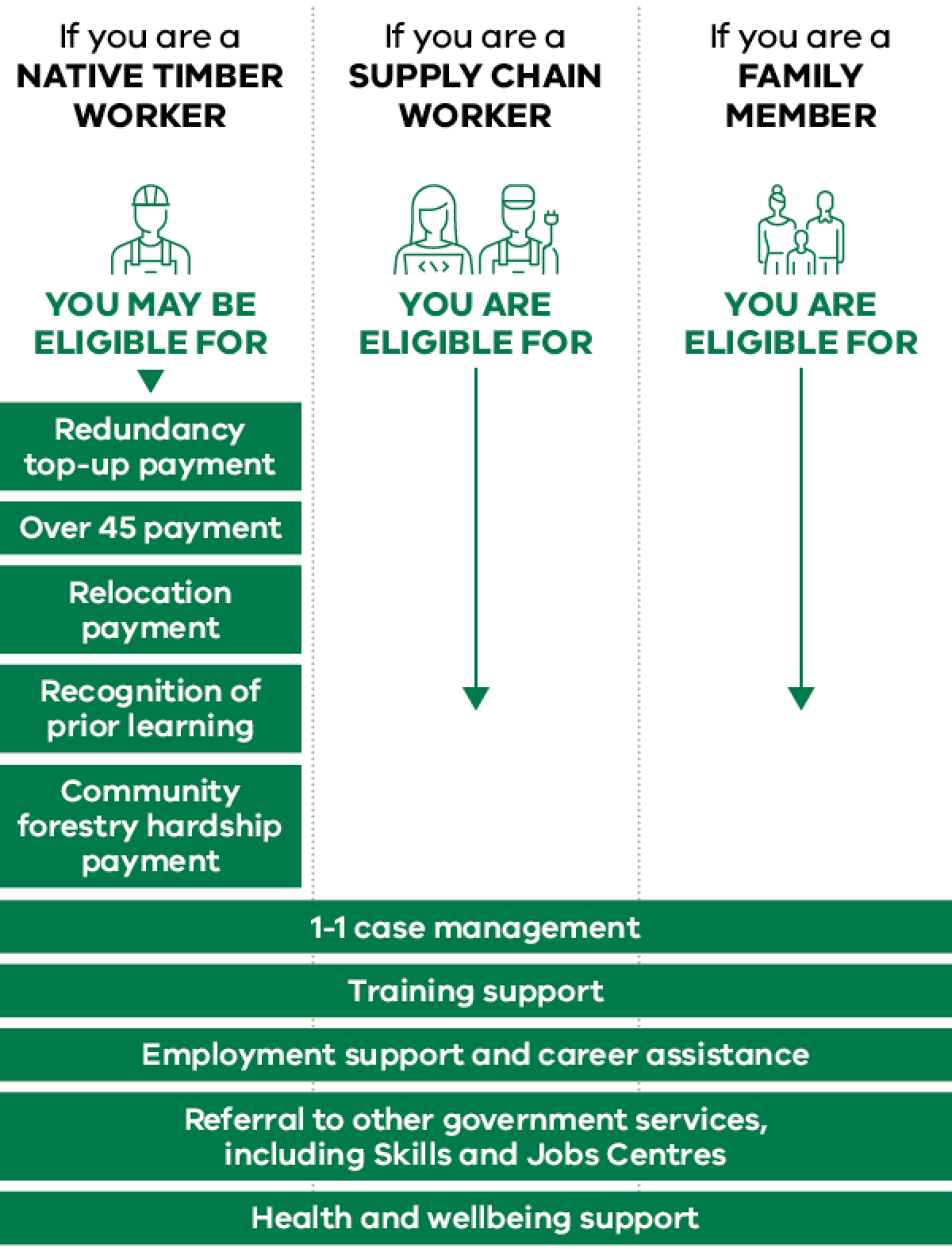

- Redundancy top-up payment

- Relocation payment

- One-off hardship payment (community forestry only)

- Over 45 payment

- 1-1 Case Management

- Funded training and recognition of prior learning, including travel

- Employment support and career assistance

- Referral to other services, including Skills and Jobs Centres

- Health and wellbeing support